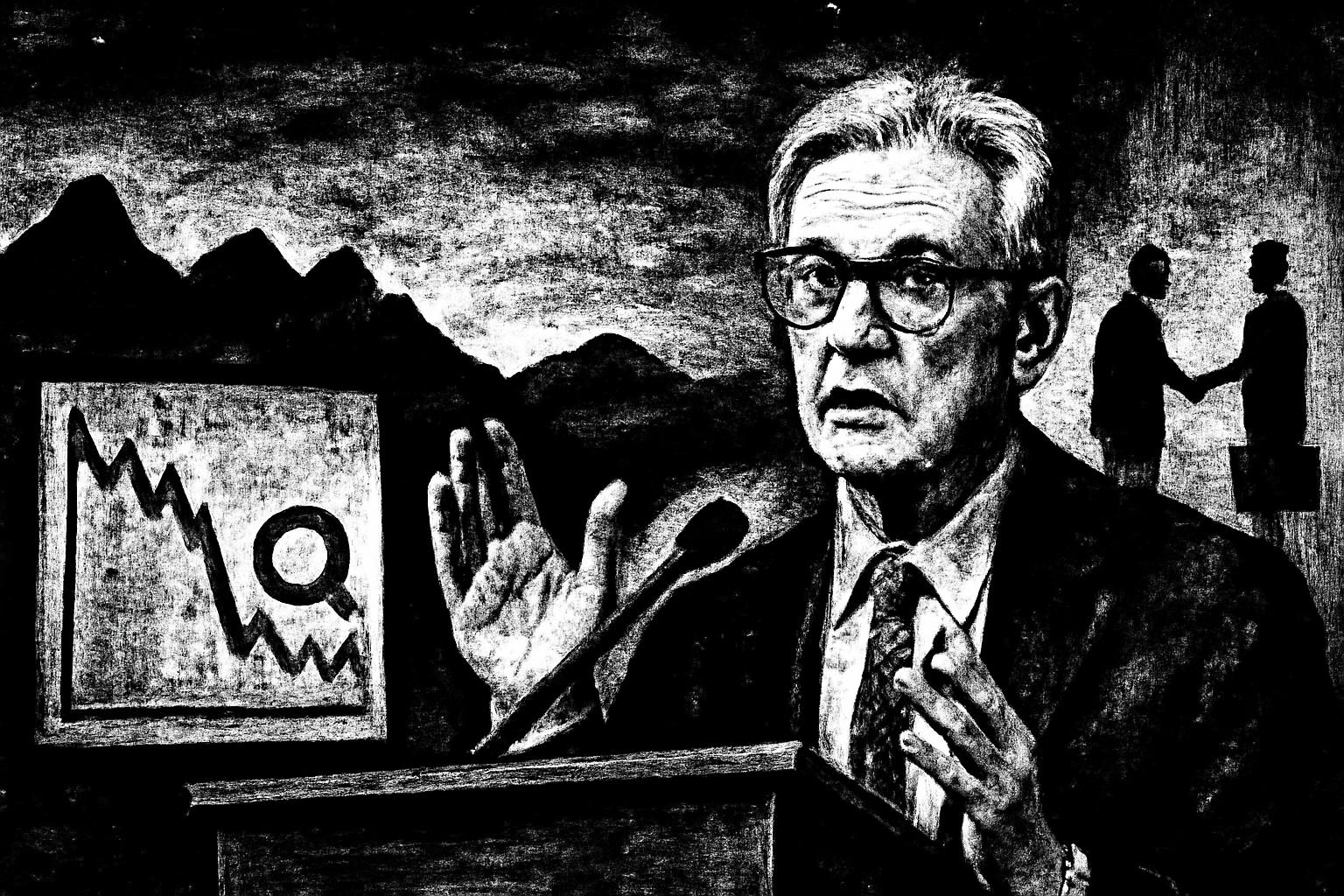

Investors are proceeding cautiously ahead of Jackson Hole, eyeing clues on the future path of U.S. monetary policy. The German DAX is opening barely higher around 24,332 points (about +0.1%), still within reach of its mid-July high but facing resistance near 24,500. Yesterday’s close was 24,314, down 0.2%. Until that hurdle is cleared, a fresh all-time high remains uncertain. Focus isn’t only on Ukraine and peace efforts but mainly on Jackson Hole, where volatility could surface. Analysts expect Powell to signal the Fed’s policy stance and avoid big surprises, perhaps not ruling out a September rate cut but unlikely a dramatic 0.5 percentage-point move. In the U.S., major indices closed largely flat: Dow at 44,912, Nasdaq at 21,630, and S&P 500 at 6,449, after the Dow briefly touched a record 45,159 on Friday. Investors await Powell’s remarks and a clearer read on inflation versus unemployment. In Tokyo, the Nikkei dipped 0.1% after a prior record, with Topix flat, signaling concerns of an overheated market. Shanghai rose 0.2% and the CSI 300 gained 0.2%. In corporate news, SoftBank is backing Intel with a multi-billion-dollar lifeline, buying about $2 billion of Intel shares around $23 each, following Bloomberg reports that the U.S. government is weighing a 10% stake in Intel.

Powell-town theatrics, coming right up. They want you to think this is all about “getting ready for the next move,” but let’s not kid ourselves: Jackson Hole isn’t a neutral academic hearing; it’s the grand stage where the central bankers thumb their noses at ordinary folks while pretending to steer the ship. Powell will jawbone with the soft, “careful, cautious” vibe, handing you a menu that contains “not ruling out a September cut” but also promises no blockbuster help. It’s the old trick: the market gets lulled into thinking a big policy shift might be coming, then handed a tepid ride so the algos keep dancing and the fat cats keep pocketing spreads. A 0.5-point cut is off the table in their book, while “a cut later” becomes the new normal, a sly way to keep debt heaps from collapsing without admitting the truth: they’re chasing victory by not losing, not by actually helping workers or Main Street.

And the spectacle around Intel? SoftBank stepping in with a $2 billion bid is not charity; it’s a power play to shore up control and liquidity in a fragile tech spine, while Washington toys with a minority stake to keep a seat at the table in chip supply that they deem “critical.” The Bloomberg rumor of a 10% government stake isn’t just a footnote—it's the kind of creeping influence that tells you: policy and profits are braided tighter than ever, and you are the last to get the memo. So you’re left watching a mild 0.1% move on a German index and hoping for a breakout that never comes, while the real moves happen off-screen: who props up which stock, who bails out which giant, and who gets to call the tune while the rest of us dance to whatever basso profundo of central-bank fiat they decide to blast next. They’ll spin “volatility could surface” as a warning to keep you scared and trading, while they quietly calibrate the levers to squeeze more yield from savers and workers alike. Wake up: the Jackson Hole show isn’t about free markets; it’s about maintaining control, preserving wealth, and keeping the system humming for those already running the game.